Understanding home insurance requirements in Pennsylvania can help homeowners protect their property and finances. Many residents want to know what the minimum coverage required by law is. By exploring the basics, legal mandates, types of coverage, exclusions, and steps for compliance, homeowners can feel more confident in their insurance choices.

Introduction to Pennsylvania’s Home Insurance Basics

Homeowners throughout Pennsylvania rely on insurance to safeguard their homes against unexpected events. In almost every case, insurance provides financial support after damage from storms, theft, fire, or other incidents. Because owning a home is a significant investment, understanding how insurance works becomes essential.

Many people believe all states set strict requirements for home insurance. However, Pennsylvania approaches things differently by not mandating specific coverage by law for all homeowners. Nevertheless, lenders usually require insurance before approving a mortgage, making insurance effectively necessary for most buyers in the state.

Additionally, the various types of home insurance policies available in Pennsylvania offer different levels of protection. Each policy covers unique risks, so knowing your options will make it easier to select the right plan. Therefore, homeowners should learn not only about the minimum requirements but also about the best practices for full coverage.

Legal Requirements for Home Insurance in Pennsylvania

Surprisingly, Pennsylvania law does not mandate homeowners to purchase insurance for their property. Still, anyone with a mortgage must meet the insurance requirements set by their lender. Because banks and mortgage companies want to protect their investments, they almost always require homeowners insurance as a condition of the loan.

Mortgage lenders typically require sufficient insurance to cover the outstanding balance of the mortgage. Additionally, they may need coverage for the structure itself, ensuring that the home can be rebuilt in the event of a disaster. As a result, even though state law does not demand insurance, most homeowners cannot avoid carrying it.

Furthermore, specific neighborhoods or housing communities might impose their own insurance requirements. For example, a homeowners association may set minimum coverage standards for all members. Consequently, homeowners should always check with their lender and local community guidelines to ensure compliance.

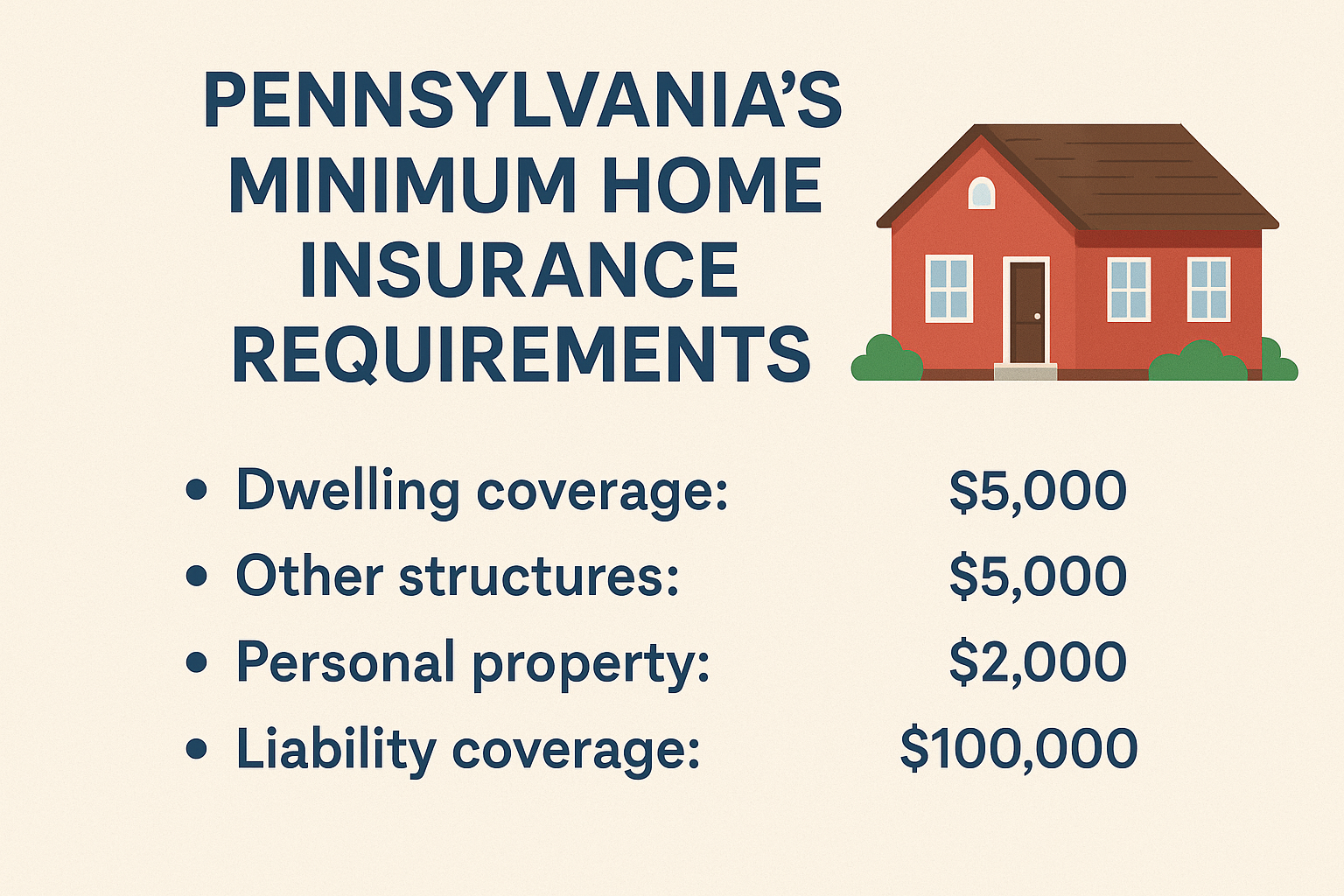

Key Coverage Types Mandated by State Laws

While the state of Pennsylvania does not mandate specific coverage types, lenders generally require certain policies. For most homeowners, basic hazard insurance is required, which protects the house against common risks like fire, wind, or vandalism. Because lenders want to avoid financial loss, they also require that insurance be maintained for the full loan term.

Additionally, some parts of Pennsylvania are prone to flooding or earthquakes. Although standard policies usually do not cover these events, lenders in high-risk areas might require separate flood or earthquake insurance. Therefore, understanding your local risks can influence the type of coverage you need to maintain.

It is also common for insurance policies to include liability coverage, which protects against lawsuits if someone is injured on your property. Lenders may also require this, ensuring homeowners can cover legal costs or damages. In conclusion, while state law does not specify these types, lender requirements often make them necessary for most buyers.

Standard Exclusions and Limitations in Pennsylvania Policies

Many standard home insurance policies in Pennsylvania do not cover every possible risk. For example, damage caused by floods, earthquakes, or landslides is often excluded. If you live in an area prone to these events, you may need to purchase separate policies or endorsements to ensure protection.

Additionally, insurance companies set limits on the amount they will pay for specific types of losses. Jewelry, electronics, and other valuables may only be covered up to a particular amount unless you purchase additional coverage. As a result, homeowners should carefully review their policies to avoid any surprises after a claim.

Another standard limitation involves wear and tear or neglect. Insurers typically do not pay for damages resulting from poor maintenance or gradual deterioration. Therefore, keeping your home in good condition and understanding your policy will help you avoid denied claims in the future.

Steps to Ensure Your Coverage Meets State Standards

Begin by reviewing your mortgage agreement and the lender’s requirements. Most lenders in Pennsylvania require you to carry insurance equal to at least the amount of your loan or the replacement cost of your home. Additionally, you should consult with your local municipality or homeowners association to verify any local rules or standards.

Next, carefully review your insurance policy to identify any exclusions and coverage limits. If you notice gaps in your protection, such as limited coverage for personal property or a lack of flood insurance, consider adding endorsements to your policy. Doing so will help you prepare for unexpected risks and ensure that your policy matches your needs.

Finally, update your insurance regularly to reflect changes in your home’s value or contents. Renovations, additions, or new purchases may require adjustments to your coverage. Keeping your policy up to date helps you meet lender requirements and provides peace of mind for you and your family.

Conclusion

Securing the right home insurance in Pennsylvania involves more than simply meeting the minimum legal requirements. While state law may not demand homeowners insurance, most lenders do, making it a necessity for any property financed through a mortgage. Understanding what your lender, community, and personal circumstances require can prevent future headaches and financial loss. Reviewing your policy thoroughly will help you spot gaps and exclusions that could affect your claim. Adding endorsements or extra coverage ensures that you remain protected against both common and uncommon risks.

Additionally, periodic review and updates will keep your policy in line with your home’s current value and your family’s needs. Not every risk is covered by standard policies, so consider special endorsements for flood, earthquake, or high-value items. Checking with local authorities or a knowledgeable insurance agent can clarify any remaining questions about compliance. By following these steps, you can feel confident that your home insurance fully protects your investment and provides peace of mind for years to come.